The COVID pandemic appears to be coming to an end with more businesses resuming normal operations and fewer reported outbreaks. Companies that suffered due to the crisis are now seeing a flurry of buying activity as investors buy deeply discounted shares in anticipation of a post-COVID recovery.

For one travel company, the post-COVID recovery is just beginning. Savvy investors who jump in early may reap outsized rewards over the next 12 to 24 months.

A Best-in-Class Entertainment and Leisure Company

Carnival Corporation (CCL) is a $28 billion cruise ship and travel services company billed as the “world’s largest travel leisure company.” The company maintains a fleet of more than 100 vessels among ten cruise line brands.

MarketClub’s Top Stocks – See Free List!

MarketClub filters out market noise to find the latest top-trending stocks. Ranked from +100 (clear buy) to -100 (clear sell) based on trend strength, momentum, and direction, this free list is constantly updated – see new finds any time!

The company reported a small fourth-quarter earnings miss of -$2.02 per share compared to the analysts’ estimates of -$1.94 per share. The company realized a net loss of $2.2 billion but maintained higher-than-expected cash and cash reserves of $9.5 billion. Management gave improved guidance for the company and set the tone for a strong comeback by 2023.

Arguably, cruise lines were among the hardest hit by the COVID lockdown, with no real potential for digital or online recourse revenue. While economic recovery seems to be picking up steam, the industry was hit by a disappointing announcement by the Centers for Disease Control and Prevention (CDC) that hasn’t helped cruise stocks recover any faster. The CDC changed its Framework for Conditional Sailing Order (CSO) to delay the cruise ship travel ban from July to November.

However, the overall sentiment is positive for both a post-COVID recovery and cruise lines in the future. Given the widespread use and effectiveness of the COVID vaccines and President Biden’s aggressive campaign to eliminate the coronavirus dangers, it is highly likely that the CDC will relax its restrictions sooner rather than later.

The stock was upgraded twice in March, with Macquarie and UBS changing their recommendations from “neutral” to “outperform” or “buy,” with the latter giving it a price target boost from $20 per share to a whopping $42 per share.

The Fundamental Case

The current negative earnings for Carnival make traditional P/E ratio analysis useless. However, an EPS growth rate of nearly 36% means that the stock is recovering quickly. The stock’s book value is currently at $22.37, giving it a price-to-book ratio of just 1.15. This ratio is a sign that the stock may be undervalued right now.

Investors should note that the stock’s beta of 2.37 means that it comes with a high degree of volatility, making it suitable for aggressive investors with a high-risk tolerance.

The Technical Case

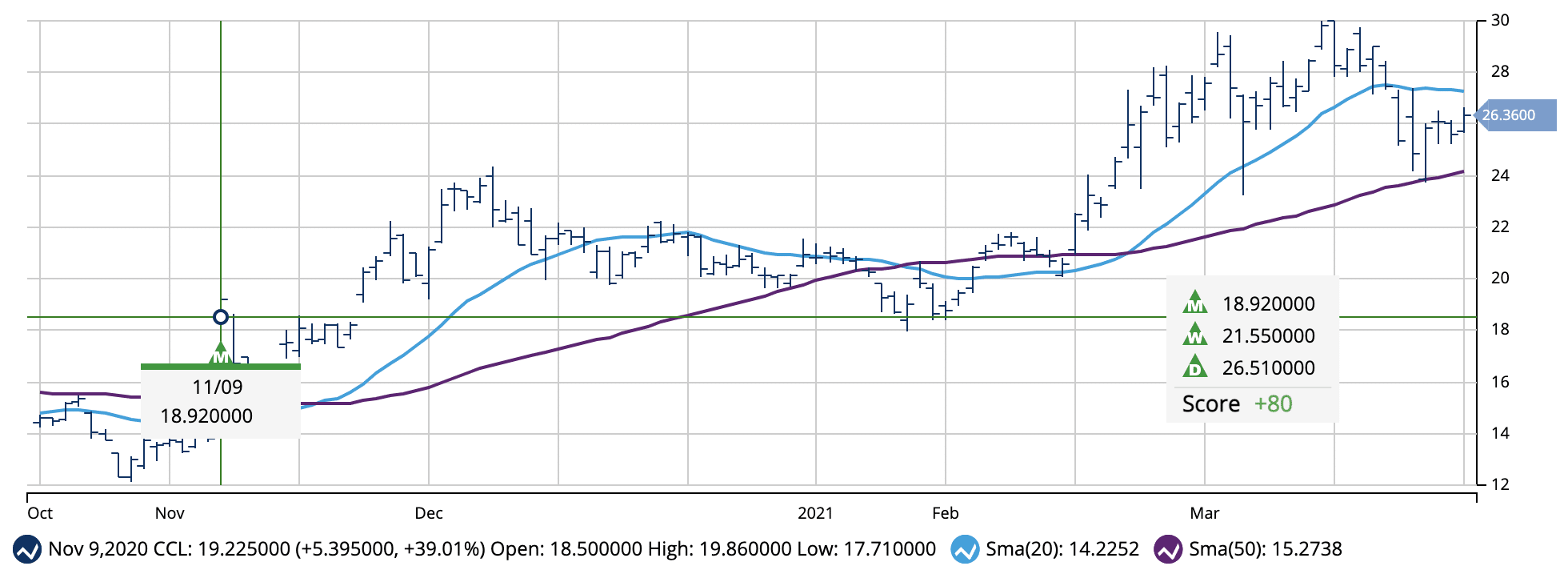

Carnival’s chart has two significant points that investors should notice.

First, the stock price has a strong general upwards trend over the past eight months – a clear break from the lull that had been plaguing the stock for most of 2020.

The second point is that the stock shows a stair-step-like pattern in its chart, with a strong bullish move higher followed by a period of relatively sideways motion. The muted RSI of just under 50, despite the recent volatility in the stock, suggests that there is more bullish strength behind this stock than bearish strength.

The Bottom Line

Based on Carnival’s full-year EPS estimates, this stock should be fairly valued at around $32 per share. A move to this price from its current trading range would represent a gain of roughly 25%.

Investors looking for a bargain pick-up and long-term hold may want to consider adding Carnival to their portfolio.

The above analysis of CCL was provided by financial writer Daniel Cross.

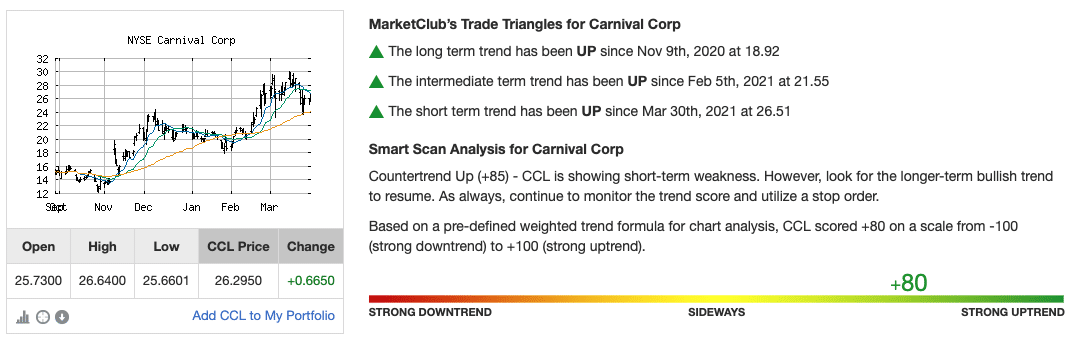

MarketClub’s Analysis of CCL

MarketClub is showing a bullish outlook for CCL.

With a +85 Chart Analysis Score, the stock is showing signs of a countertrend with some short-term weakness. However, the long-term bullish trend is pointed in a higher direction.

MarketClub members following a long-term strategy are riding a trend originally established on November 9, 2020. That new trend was indicated by a green Trade Triangle at $18.92. The stock has since climbed $7.43/share or 39.2%.

Regardless of the MarketClub strategy, members are looking for the stock’s trend to strengthen and the price to climb. If CCL fails to climb and our analysis detects weakness, the Chart Analysis Score will warn members.

Join MarketClub to see the Chart Analysis Score for CCL and the next signal.