Earnings season hasn’t been kind to investors so far. And with more companies warning of less than impressive results, investors are scrambling for a safe place to find profits.

Value stocks return to the forefront for investors who are looking for a high-yield dividend payer.

For one high-yield energy stock, defense and growth fit neatly into one package that investors shouldn’t pass up.

A Best-In-Breed Oil and Gas Refining Conglomerate

Valero Energy Corporation (VLO) is a $35 billion oil and gas refining company with 15 refineries located in the U.S. and Canada, with another located in Wales. The company also operates 11 ethanol plants and a 50-megawatt wind farm.

The company reported an impressive first-quarter earnings beat of $0.34 per share compared to the $0.23 that analysts had expected. Higher ethanol production accounted for the EPS surprise, but total revenues fell 8.2% from the prior quarter.

One of the biggest catalysts working in Valero’s favor is the recent trade war scare. Oil prices tend to react very strongly to geopolitical tensions, giving the stock a boost as volatility rises. The large draw-down of 13 million barrels the other week helped boost oil prices as well sending Valero’s stock price higher.

The company has had a string of upgrades over the past several months including JP Morgan and Goldman which upgraded the stock from a “neutral” recommendation to a “buy” one. The price targets ranged between $96 to $105 per share – a narrow bandwidth that, even on the lower end, translates into a gain of well over 10%.

Fundamental Analysis of VLO

The stock trades cheaply at just 13 times earnings compared to the industry average of 20 times earnings. It also comes with a high estimated future EPS growth rate of 19%. The stock’s PEG ratio is well under 1. This ratio is a strong sign that the stock is deeply undervalued right now.

As a value play, the stock also comes with a hefty 4.25% dividend yield, giving investors plenty of downside protection. And the dividend payout ratio of just 50% should reassure investors that the safety net is there to stay.

Technical Analysis of VLO

Valero’s chart has been choppy over the past few weeks following the general market trend this earnings season. But the trough appears to be a temporary thing with the shorter 20-day SMA rising quickly against the 90-day SMA. The reversal pattern developing is a sign that bullish momentum is back in charge and should continue to drive the stock higher in the coming months.

The Bottom Line

Based on Valero’s full-year EPS estimates, this stock should be fairly valued at around $100 per share – a gain of 19% from its current trading range. Earnings season may be a tough one, but for investors in this value play, profits won’t be missed.

The above analysis of VLO was provided by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis of VLO

MarketClub’s tools cite VLO’s trend as weak and uncertain with a Chart Analysis Score of -55.

The stock will have to make a strong and consistent movement in one direction or another to shift our rating closer to a strong uptrend (+100) or strong downtrend (-100).

Our Trade Triangle signals are also mixed. Our long-term and short-term signals are pointing down, while our intermediate-term signal is pointing up.

Therefore, members would be sitting on the sidelines for VLO waiting for the chart score to strengthen in one direction or another.

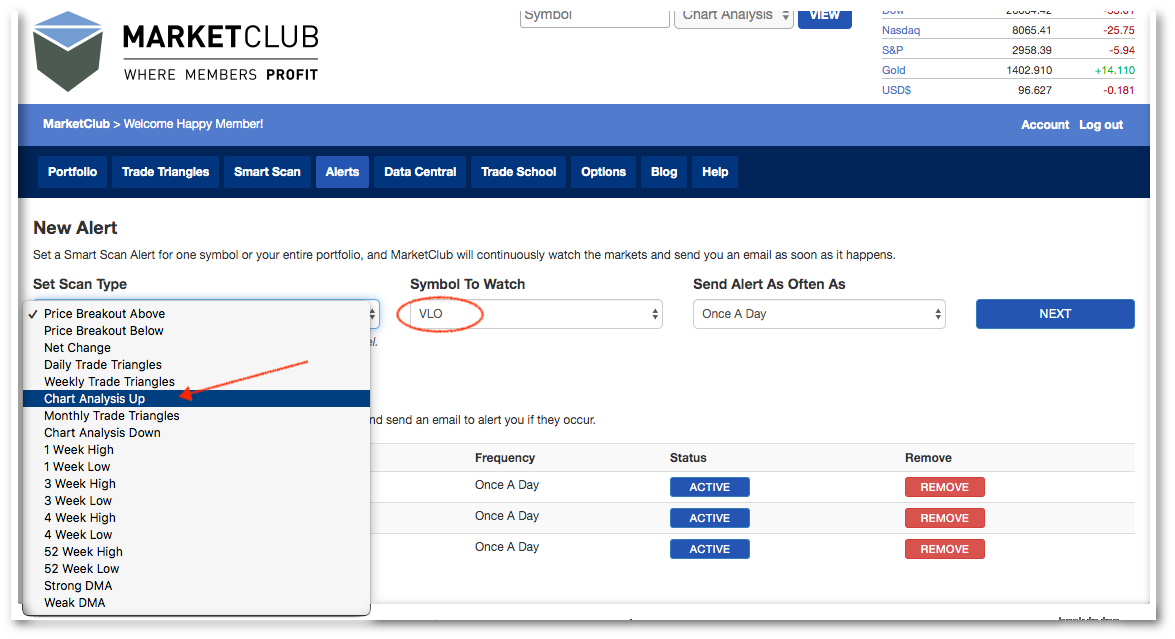

Sitting on the sidelines does not mean that members have to sit in front of their computers watching the score – our alert system will watch VLO (or any watchlist or portfolio holding) for you!

Even though MarketClub is not bullish on Valero Energy Corporation (VLO), there are strong signals and scores for thousands of other stocks, ETFs, futures, forex, and mutual fund markets right now.

Our simple scans will quickly share the strongest trending markets and new trading opportunities.

Join MarketClub right now, set an alert for VLO, and start scanning for markets ready to break out.