If you look at any of these precious metal ETF charts, you’ll notice that a strong bullish trend has been rockin’ since the new year.

With some short-term weakness, it may look like these trends have cooled – but, look again.

New MarketClub signals have confirmed that the upward trend remains strong for these precious metal exchange-traded funds.

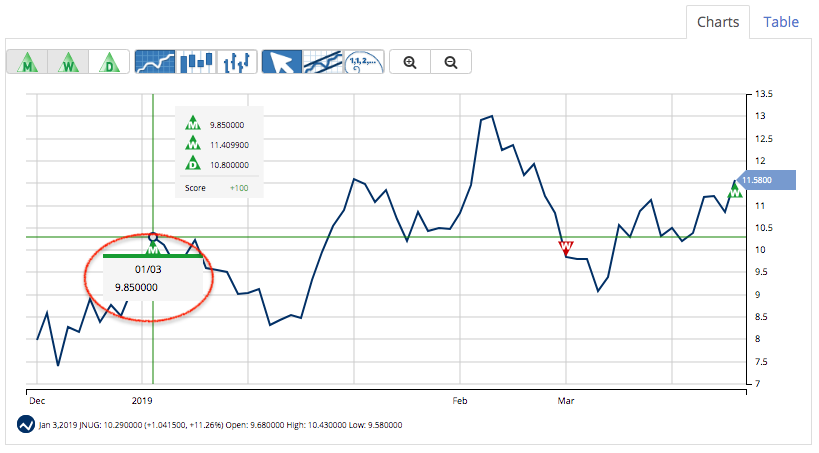

Direxion Daily Junior Gold Miners Index Bull 3x Shares – JNUG

JNUG is up $1.70 (17.26%) since the last monthly signal was issued on 1/3/19 at $9.85.

The Direxion Daily Junior Gold Miners Index Bull and Bear 3X Shares seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the MVIS Global Junior Gold Miners Index.

iShares Silver Trust – SLV

SLV is up $0.54 (3.85%) since the last monthly signal issued on 12/26/18 at $14.02.

The iShares® Silver Trust (the ‘Trust’) seeks to reflect generally the performance of the price of silver.

VanEck Vectors Junior Gold Miners – GDXJ

GDXJ is up $3.17 (10.46%) since the last monthly signal issued on 1/2/19 at $30.31

VanEck Vectors® Junior Gold Miners ETF (GDXJ®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Global Junior Gold Miners Index (MVGDXJTR), which is intended to track the overall performance of small-capitalization companies that are involved primarily in the mining for gold and/or silver.

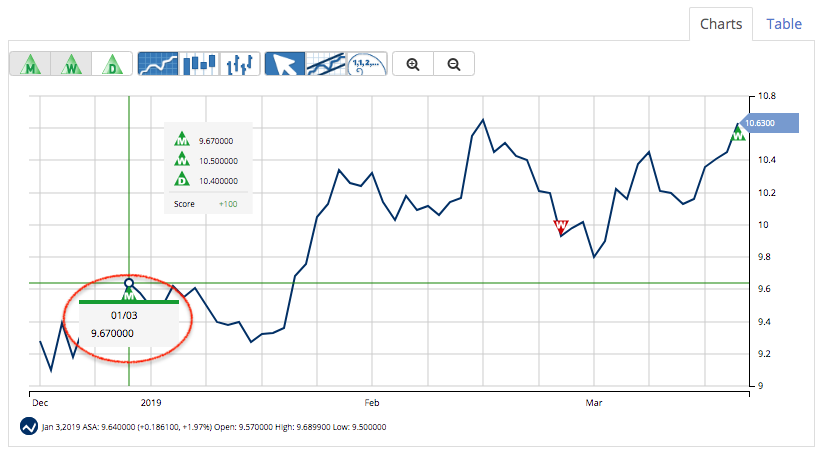

ASA Gold & Precious Metals Ltd – ASA

ASA is up $0.94 (9.72%) since the last monthly signal issued on 1/3/19 at $9.67.

Established in 1958, ASA Gold and Precious Metals Limited (“the Company”) is a closed-end precious metals and mining fund registered with the United States Securities and Exchange Commission and domiciled in Bermuda. The Company is one of the oldest investment management firms focused solely on the precious metals and mining industry.

ProShares Ultra Silver – AGQ

ACQ is up $0.96 (3.84%) since the last monthly signal issued on 12/26/18 at $24.99.

ProShares Ultra Silver seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of the Bloomberg Silver SubindexSM.

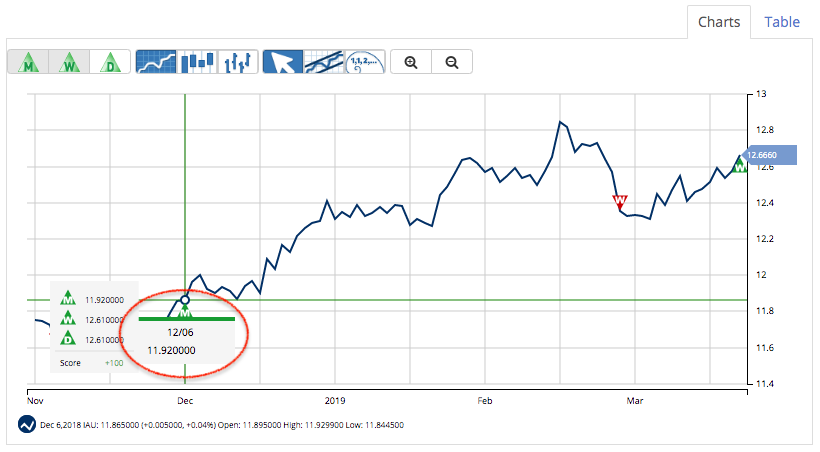

iShares Gold Trust – IAU

IAU is up $0.75 (6.29%) since the last monthly signal issued on 12/6/18 at $11.92.

The iShares Gold Trust (the ‘Trust’) seeks to reflect generally the performance of the price of gold.

Get The Next Signals for These ETFs

Join MarketClub now to get the next signal for these ETFs and scans to show what sectors are heating up next.

*Gains taken as of the closing price on 3/25/19.