A solid foundation is important for any portfolio, regardless if you’re a conservative or aggressive investor. A good anchor stock should be a large-cap pick in a defensive industry and offer a dividend yield that at least matches the rate on the 10-year treasury.

For one economically independent company, a strong customer base and a sky-high dividend yield make it standout anchor stock.

A Dividend-Paying Superstar and Recession-Proof Powerhouse

Altria Group (MO) is a $77 billion tobacco conglomerate and one of the world’s largest producers of tobacco and cigarette products. Altria is Phillip Morris USA’s parent company, best known for its Marlboro cigarette brand. The company also owns a stake in a Canadian cannabis company and a stake in JUUL – a maker of e-cigarettes.

The company reported a third-quarter earnings beat of $1.19 per share, exceeding the analysts’ estimate of $1.16 per share. Revenues climbed 4.92% to $5.678 billion as well.

The company has two solid catalysts working in its favor. For one, it has a very reliable customer base and a business that isn’t dependent upon the state of the economy. That makes it a strong candidate for both bullish and bearish markets.

The other catalyst is the strong fundamentals in the stock. The high dividend yield of more than 8% is in no danger of being cut, while the stock’s cheap P/E and high future growth prospects make it an ideal value pick-up for investors.

The Fundamentals

The stock trades extremely cheaply at just 9 times earnings, while the tobacco industry trades at an average of 33 times earnings. The strong 11% long-term estimated EPS growth rate gives it a PEG ratio of less than 1 – a very strong sign that the stock is undervalued.

Undoubtedly, the stock’s most attractive feature is its massive 8.35% dividend yield. Not only does this give investors a competitive gain from income alone, but it also helps protect against downside movements. The relatively muted beta of 0.62 makes it resilient against high volatility.

The Technicals

Altria’s chart shows a pattern of ups and downs that generally build higher peaks each time they occur.

While the stock has been trading sideways over the past week or two, a classic hammer signal forming at the end of last week could indicate a shift to more bullish momentum. The 20-day SMA is above the 50-day and 200-day SMA, which could help build up momentum faster.

The Bottom Line

Based on Altria’s full-year EPS estimates, this stock should be fairly valued at around $47 per share. A moved to this price would represent a gain of more than 14% from its current trading price. Adding in a reinvested dividend brings up the total potential gain to around 22%.

For investors, this stock is an ideal anchor to build any type of portfolio around.

The above analysis of MO was provided by Daniel Cross, professional trader and financial writer.

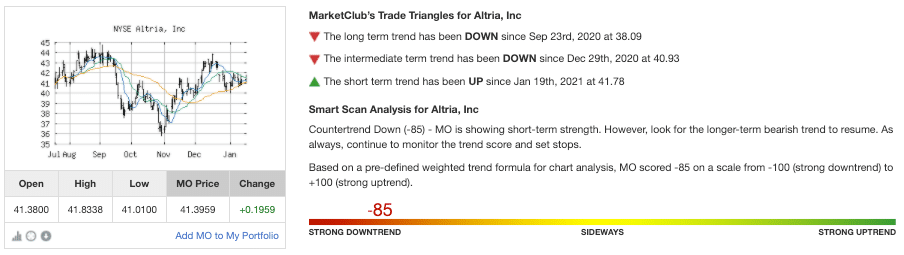

MarketClub’s Analysis of MO

Based on MarketClub’s full analysis, Altria, Inc. (MO) is in the confines of a strong downward trend.

While a Smart Scan Score of -85 points to a continued bearish move, MO has gathered some short-term momentum. MarketClub members will watch MO for a weekly Trade Triangle suggesting that the stock may be beginning a major trend shift.

Want a free technical analysis report, including the Chart Analysis Score for MO or 350K other markets?

Click the button below to request your free report for any U.S. or Canadian stock!