Global stock prices have been on a nasty slide as Wall Street weighs the probability of a worldwide coronavirus pandemic.

As of this morning, Southwest Airlines Co. (LUV) dropped more than 19% in the last 5 trading days. Fellow travel company Carnival Corporation (CCL) had experienced more than a 28% drop in that same time period before seeing a small recovery.

Travel hasn’t been the only sector to see double-digit drops. Alcoa Corp. (AA), Apple Inc. (AAPL), and Tesla (TSLA) also followed the broader market’s move.

While many stocks look to be infected by the coronavirus panic, the stocks below may be immune with a +90 or +100 Chart Analysis Score and the momentum to push higher.

5 Stocks Pushing Higher Despite Coronavirus Panic

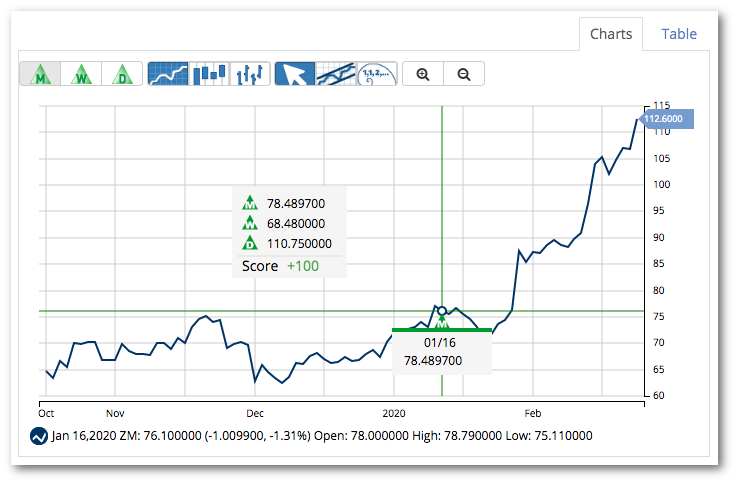

Zoom Video Communications, Inc. (ZM)

Zoom is a video communications platform that allows people from all around the world to connect. Users can join a meeting from various devices for a number of professional, personal or educational purposes.

Avg. Volume: 3,577,700

Market Cap: 31.13B

Monthly Green Trade Triangle: 1/16/20 at $78.48

Smart Scan Score: +100

The stock has been in a strong uptrend since members received a monthly Trade Triangle on January 16, 2020, at $78.48.

Since the last signal, Zoom Video is up $34.47/share (+43.4%). The stock continues to push higher despite the general market sentiment.

Teladoc Health, Inc. (TDOC)

This virtual healthcare services company uses technology to connect patients with providers. Teledoc covers non-critical, chronic care, and other behavioral health services.

Avg. Volume: 6,344,916

Market Cap: 10B

Monthly Green Trade Triangle: 7/1/19 at $66.56

Smart Scan Score: +100

TDOC has been been on a rocket up since members received a monthly Trade Triangle on July 1, 2019, at $66.56.

The stock began to climb before taking off in January and then exploding on coronavirus panic. Since the last signal, members would be showing a $79.26/share gain (+119%) and would be looking for a change in Smart Scan Score to capture profits.

Cloudflare, Inc. (NET)

This cloud platform delivers a number of services to customers in the consumer, healthcare, sciences, and education industries among many others.

Avg. Volume: 3,661,568

Market Cap: 6.6B

Monthly Green Trade Triangle: 2/20/20 at $19.80

Smart Scan Score: +90

NET began trading in October of 2019. After a move into the $17.25-$18.25 range in late 2019, the stock jumped in February of 2020.

Members received a monthly Trade Triangle on February 20, 2020, at $19.80. NET jumped $2.60/share (+13.1%). With a Chart Analysis Score of +90, this stock has the momentum to continue the climb.

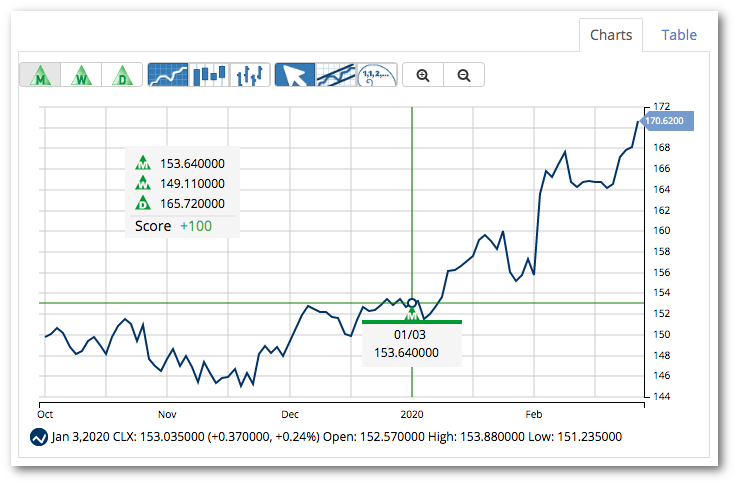

The Clorox Co. (CLX)

This well-known company manufactures and markets cleaning and household supplies. Their product lines include laundry additives, bleach, stain fighters, and disinfectants.

Avg. Volume: 2,777,110

Market Cap: 21.2B

Monthly Green Trade Triangle: 1/3/20 at $153.64

Smart Scan Score: +100

After a choppy 2019, CLX began climbing at the start of the new year. MarketClub members received a green monthly Trade Triangle on the first trading day of the year at $153.64.

After identifying this change in the long-term trend, CLX sprang up $16.98/share (+11%).

Virtu Financial, Inc. (VIRT)

This company provides market-making services through its technology platform.

Avg. Volume: 964,987

Market Cap: 3.5B

Monthly Green Trade Triangle: 2/4/20 at $17.44

Smart Scan Score: +100

MarketClub detected a long-term trend change on February 4, 2020, at $17.44. Since issuing a green monthly Trade Triangle, VIRT has jumped $1.55/share (+8.8%).

The Chart Analysis Score suggests that VIRT still has the technical support to continue its upward move. Members will be looking for a change in score or new signal to capture profits.

While the market is likely to see continued volatility, MarketClub members need not worry.

Our system never stops scanning over 350K symbols looking for trend shifts, warnings signs, and new opportunities. So while many stocks may follow the broader market, our technology won’t stop looking for new opportunities for members.

Try MarketClub for the next 30 days, test our tools, and find new opportunities in the midst of a viral panic.