When investors think of materials stocks and those in the mining industry specifically, there are usually a few staples that come to mind. Gold, silver, copper, aluminum, and steel are generally the front-runners for mining stocks.

But as technology advances, so too does our need for more complex construction materials – and that means that the rare earth metals and minerals industry could be the next big investment play in the upcoming years.

For one rare earth metals producer, underrepresentation and growing global demand could mean a stock price that’s trading far below its actual intrinsic value.

A Domestic Rare Earth Metals Producer and Deep Value Stock Addition

MP Materials Corp. (MP) is a $7.7 billion rare earth metals mining company based in California. It operates the only rare earth metals mine in the U.S., Mountain Pass Mine. In addition, the company primarily sources Neodymium-Praseodymium, which is used in high-strength magnet construction.

The company reported impressive third-quarter earnings at $0.27 per share, more than 60% higher than analysts’ estimates of $0.17 per share. Revenues soared 143% year-over-year as well, with management citing strong demand for rare earth elements.

As the name suggests, rare earth metals and minerals are not overly abundant on Earth. These elements are usually measured in ppm (parts per million) compared to other natural resources such as copper or iron.

The greatest concentration of rare earth elements is in China, which has meant increased geopolitical risk in these types of foreign mining stocks over the past few decades. But, as a domestic producer of rare earth elements, MP Materials could be the answer for the technology and construction industries.

One of the biggest catalysts for the stock is the booming EV (electric vehicle) market. EV motors require rare earth elements, which means that mining demand should steadily rise over time. The company’s specialty element of Neodymium-Praseodymium is vital in EV motor designs and should positively correlate with the EV industry over the next few years.

Fundamental Groundwork

As is the case with other mining stocks, standard price-to-earnings ratio analysis isn’t the primary valuation factor. Rather, the expected mine reserves are generally referenced as the leading value marker.

For Mountain Pass Mine, it has a lifespan of 24 years even after production ramped up to roughly double in just a year. The fast-paced growth should help propel the stock forward despite the stock market’s up and down cycles.

Technical Outlook

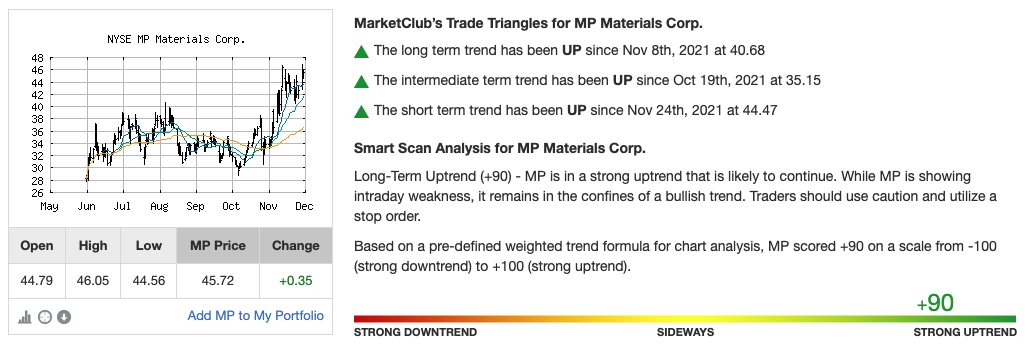

The chart for MP Materials shows a stock with a relatively high degree of volatility but trending higher as it oscillates through short peak-trough cycles.

The 20-day SMA is well above the 50-day and 200-day SMAs, while the candlesticks show a weak hammer pattern – both bullish signs for the stock continuing to move upwards.

One note of caution comes from the relatively high RSI of 62. This could be either an “overbought” signal or simply just another strong bullish signal stemming from strong buying activity from investors.

The Bottom Line

Based on MP Materials’ full-year EPS estimates, this stock should be fairly valued at around $50 per share. A move to this price would represent a gain of more than 17% from its current trading price.

Investors interested in a speculative value stock play with long-term potential growth prospects should take a closer look at this rare earth metals and minerals mining enterprise.

The above analysis of MP Materials Corp. (MP) was provided by financial writer Daniel Cross.

Get The Next Signal for MP

What’s the long-term outlook for MP Materials Corp. (MP)? Will the stock follow its overarching trend or make a quick reversal?

Get the next signal for MP and analysis for over 350K markets with a 30-day MarketClub trial.