The markets appear poised for a correction. Many analysts are bracing for a pullback of 10% or more.

The bull market has been charging ahead for some time now and has driven market valuations to levels far above average. The historical average P/E for the S&P 500 Index is about 15 times earnings – but right now, the average multiple is more than 35 times earnings.

With the markets trading at high multiples, avoiding hype and picking successful companies with strong fundamentals is essential.

One defense contractor has been raising expectations and delivering steady returns, appealing to both growth and value-minded investors.

A Best-in-Class Defense Contractor and Growth Stock Play

General Dynamics Corporation (GD) is a $56 billion aerospace and defense contractor and the third-largest in the world by sales. The company manufacturers several vehicles used for commercial and military use, such as the Gulfstream jet, M1 Abrams tank, Stryker armored truck, and many more.

The company reported a second-quarter earnings beat of $2.61 per share compared to the analyst consensus of $2.55 per share. Revenues came in at $9.2 billion, matching expectations. On top of that, management upped FY2021 guidance to $11.50 following the quarterly beat.

One of the biggest catalysts for General Dynamics is its impressive backlog of projects and contracts. As of the end of the second quarter of 2021, the total backlog for the company was around $89.2 billion. Combined with GD’s consistent dividend payout and stock buyback programs, investors should have a safe bet to ride out any future stock correction.

May was the last month that the stock saw any analyst coverage, with Wells Fargo issuing an “overweight” recommendation with a price target of $216 per share.

Fundamental Basis

The stock trades at 17 times earnings, coming in just under the defense industry’s average of 19 times earnings. The projected long-term EPS growth rate at roughly 8% gives it an overall PEG ratio of close to 2, signifying that the stock may be trading at undervalued prices.

GD also comes with a 2.35% dividend yield which offers investors some income while protecting against sustained downside movements.

Technical Basis

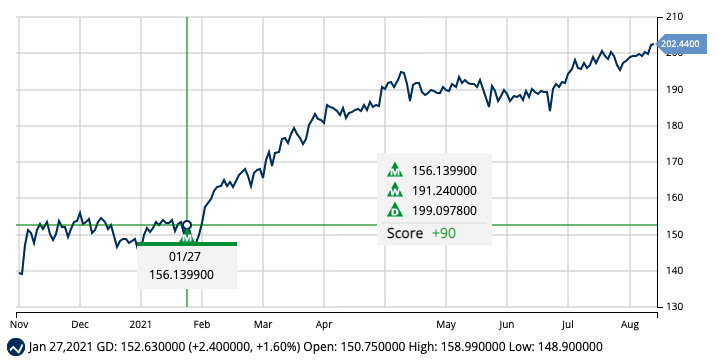

The stock chart for General Dynamics doesn’t show a lot of volatility or uncertainty over the past several months. There is a general slope upwards with the 20-day SMA trending above the 50-day and 200-day SMAs suggesting ongoing bullish activity from investors. However, like most stocks in the market, there is a concern of a pullback with the RSI currently reading around 63.

Investors may want to establish a position in the stock slowly over time to avoid any sudden corrections.

The Bottom Line

Based on General Dynamic’s full-year EPS estimates, this stock should be fairly valued at around $220 per share – a gain of roughly 10% from its current trade price.

Investors looking for a long-term defensive holding that also offers plenty of growth will find that General Dynamics is an ideal match.

The above analysis of General Dynamics Corporation (GD) was provided by financial writer Daniel Cross.

Complete Technical Outlook for GD

What’s the long-term outlook for General Dynamics Corporation? Will the stock follow its overarching trend or make a quick reversal?

Get the next signal for GD and analysis for over 350K markets with your MarketClub Trial.