Inflation is one of the most damaging and persistent portfolio enemies.

It eats away at profits and can do significant damage over a long period. Even something relatively minor adds up, thanks to the magic of compounding. But there are ways of staying ahead of the curve and even using inflation to boost portfolio profits.

For one mining company, inflationary markets are where it thrives, giving investors a way to stay profitable and consistent.

A Best-in-Class Mining Company and Inflation-Resistant Stock Play

Newmont Corporation (NEM) is a $57 billion gold mining company and the largest gold miner in the world. In addition to gold, it also mines copper, silver, lead, and zinc.

The company narrowly missed EPS expectations for the first quarter at $0.74 per share compared to the $0.77 per share that analysts had predicted. Production was down 2% from last year, but higher metals prices helped boost revenues. Looking ahead, the company’s investments in technology and efficiency make the stock a value pickup for investors.

The CPI (Consumer Price Index) is a commonly referenced tool for measuring inflation in the economy. It rose 0.6% for all items in May, bringing the total increase over the past 12 months to 5%. While many expect action from the Federal Reserve to help curb the inflationary threat, many more think that higher inflation is here to stay.

One of the best defenses against inflation is investing in commodities. Gold stands out as the number one hedge against devalued currencies and inflationary attrition. As an asset class, its wealth preservation capabilities make it the perfect place to keep money safe from volatile markets and inflation.

Fundamental Strength

Mining stocks aren’t analyzed using typical ratio metrics like P/E. Instead, the most critical component is the cost of production relative to the price of gold. Newmont’s estimated all-in sustaining costs for 2021 is $970 per ounce, while the current price of gold stands at $1,868.8 per ounce. That gives the company a wide berth of continued profitability.

NEM also comes with a strong 3.10% dividend yield, giving investors a steady income stream and protecting against sustained downside movements in the stock. The low beta of 0.31 means less volatility for investors and lower portfolio risk overall.

Technical Power

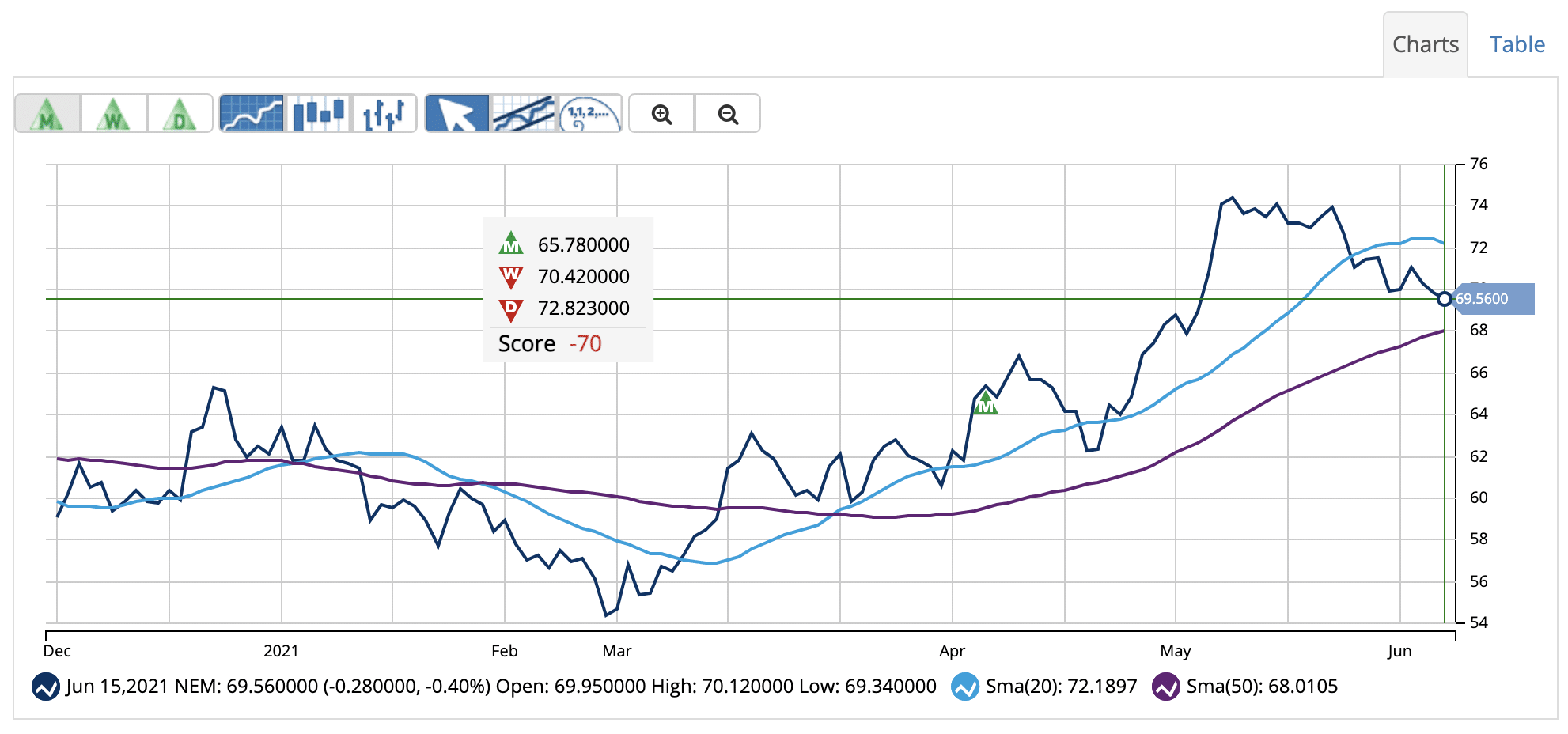

Newmont’s chart shows some recent strength in the stock price beginning in early March.

The 20-day SMA is trending well about both the 50-day SMA and 200-day SMA, indicating that the bulls outnumber the bears.

The RSI reading of 47 indicates that the stock is neither overbought nor oversold at the moment, so investors will want to watch for any future bullish or bearish signals over the next week or two.

The Bottom Line

Based on Newmont’s full-year EPS estimates, long-term inflationary expectations, and gold price estimates, this stock should be fairly valued at around $76 per share – a gain of around 13% with the dividend reinvested.

Investing in this gold mining staple is a great way to hedge against inflation without giving up on long-term solid growth in your portfolio.

The above analysis of Newmont Corporation was provided by financial writer Daniel Cross.

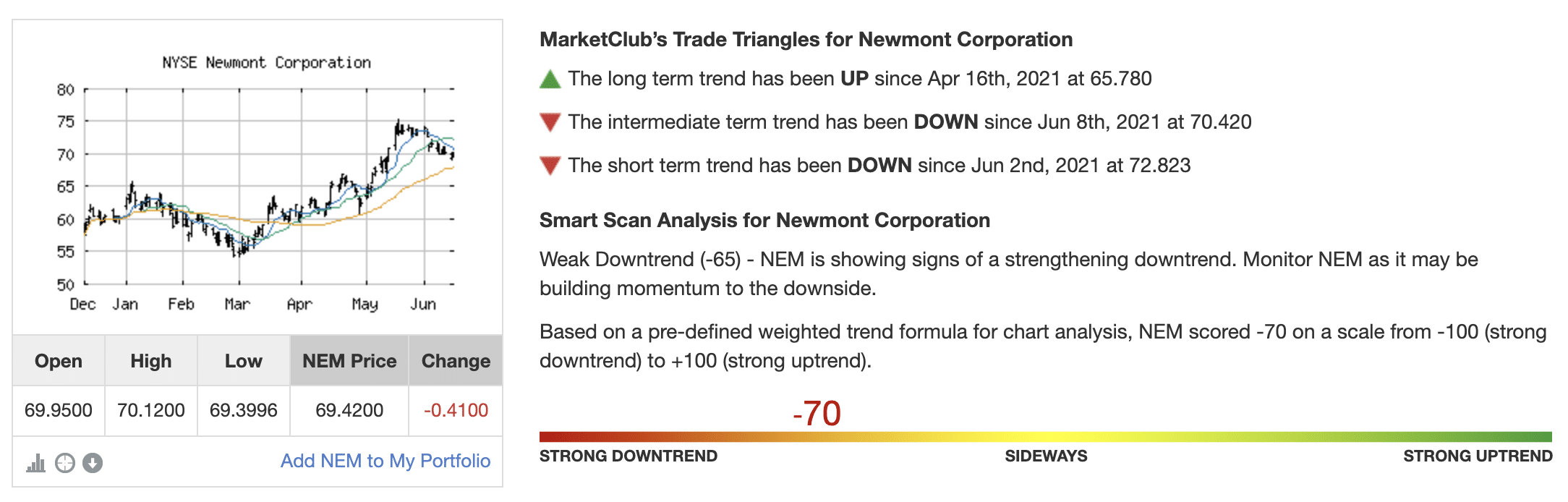

MarketClub’s Analysis for Newmont Corporation (NEM)

With recent weakness, NEM is showing a -70 Chart Analysis Score. This score suggests that the stock is strengthening to the downside.

While the long-term trend remains bullish, MarketClub members will use caution given the short-term weakness.

Get a free daily report for NEM or any other U.S. or Canadian stock.