While biotechnology has taken center stage with the newly developed COVID-19 vaccines, another healthcare industry has gone surprisingly unnoticed.

In the case of one pharmacy retailer, demand for the new vaccine and a management team committed to winning long-term customers make the stock a must-watch for investors.

Beyond coronavirus, preventative treatments and other medicinal products sold by this company are a consumer need regardless of short-term demand.

A Best-in-Breed Neighborhood Healthcare Retailer

CVS Health Corporation (CVS) is a $91 billion healthcare pharmacy retailer and the United States’ largest chain. In 2016, the company operated more than 9,600 locations. CVS sells prescription and over-the-counter medications in addition to beauty products, photo services, and convenience groceries.

The company reported a third-quarter earnings beat of $1.66 per share. This announcement exceeded the $1.33 per share that analysts had expected. Revenues climbed 3.5% for the quarter while management raised future guidance for the company.

The biggest catalyst for CVS at the moment is the COVID-19 vaccine that consumers will be able to acquire through their local pharmacy. But beyond that, the recent integration of Aetna gives the company strong long-term prospects that will benefit consumers for years to come.

The stock hasn’t had much analyst activity lately. The most recent was back in September when Piper Sandler initiated coverage with an “overweight” recommendation and set a price target of $72 per share.

Fundamental Health

The stock trades incredibly cheaply at just nine times earnings, compared to the drug retailers industry average of 26 times earnings.

The long term projected EPS growth rate of around 10% means that it comes with a PEG ratio of less than 1 – a strong sign that the stock is undervalued.

The relatively low beta value of 0.81 means that the stock is robust against volatile markets as well. As a solid defense stock, CVS carries a beefy 2.9% dividend yield. This yield gives investors protection against sustained downside movements.

Technical Workings

The release of the COVID-19 vaccine can explain the roller-coaster-like chart for CVS over the past two months. Overall, the stock is moving higher and isn’t showing signs of being overbought yet with an RSI of 56.

Back in early December, a striking “three white soldiers” pattern occurred during a strong uplift. The same pattern may be forming again, which could lift the stock to new highs.

The Bottom Line

Based on CVS’s full-year EPS estimates, this stock should be fairly valued at around $82 per share. A move to this price would represent a 17% gain from its current trading price.

For investors who are optimistic about the new year but still want to maintain a defensive position, this stock is an ideal fit for both conservative and aggressive portfolios.

The above analysis of CVS was provided by financial writer Daniel Cross.

MarketClub’s Analysis of CVS

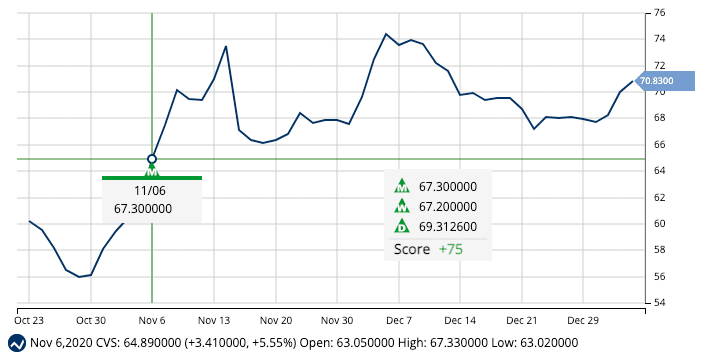

CVS is showing bull market weakness with a +75 Chart Analysis Score. While we’ve seen a short-term slowdown, the stock remains in the confines of a long-term uptrend.

The last monthly Trade Triangle triggered on November 6, 2020, at $67.30. The price of CVS has since jumped $3.51/share (5.23%) and the trend remains steady.

MarketClub will continue to monitor every price tick for CVS, ready to detect if and when the bullish trend begins to turn.

Join MarketClub now to get the signals, daily analysis, and trend score for CVS.