The summer is hot and so are the markets, led by big tech and pharmaceutical stocks.

In July, the Dow Jones Industrial Average finished up a tad over 2% while the Nasdaq moved by almost 7%. But, it wasn’t all good news.

A rash of bankruptcies, a number of new COVID-19 outbreaks, and Capitol Hill squabbling continued to make headlines and muddy the outlook for August 2020:

- Some of the most well-known U.S. retailers file for bankruptcy

- Dr. Brix warns that COVID is extraordinarily widespread and hitting new areas of the U.S.

- Deadlock on stimulus due to disagreements on unemployment assistance

As we’ve said before and we’ll say again – as technical traders, we pay more attention to the charts and less attention to the news!

|

This list ranks the top options based on trend, volume, price, and our proprietary algorithm. |

Opportunities are everywhere if you know where to look. As the summer wraps up, these stocks are still red hot.

Hottest Stocks for August 2020

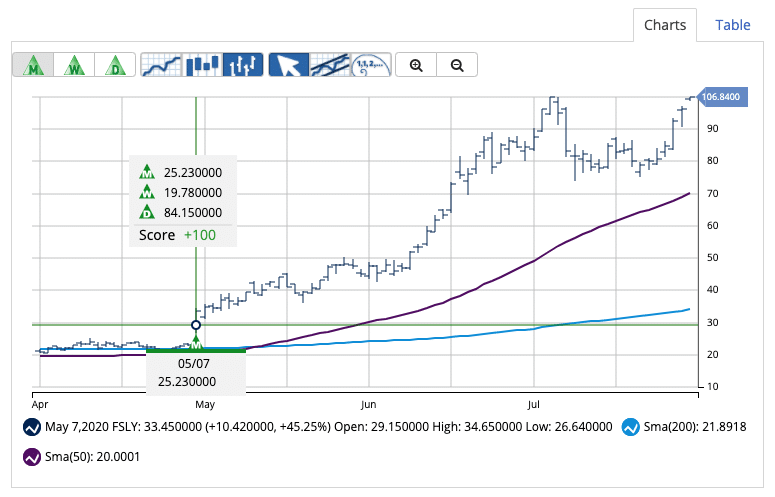

Fastly, Inc. (FSLY)

This growing company operates a cloud platform to process, serve, and secure its customers’ applications. Fastly services customers in the publishing, hospitality, technology, and financial industries.

Avg. Volume: 8,602,506

Market Cap: 11.1B

Monthly Green Trade Triangle: 5/7/20 at $25.23

Smart Scan Score: +100

MarketClub members following the long-term strategy have been holding FSLY since May 7, 2020. After a new Trade Triangle was issued at $25.23, the stock’s price shot up, taking members along with it.

As of August 3, 2020, the stock is up more than 323% since the last signal.

With a Chart Analysis Score of +100, FSLY is still in a strong uptrend.

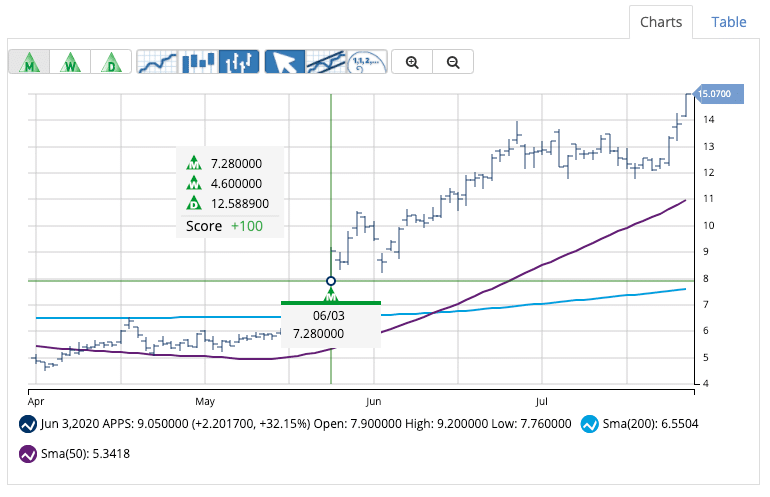

Digital Turbine, Inc. (APPS)

Digital Turbine, Inc. provides media and mobile communication products and solutions. Headquartered in Austin, Texas, this company also provides advertising and targeted media services.

Avg. Volume: 2,462,292

Market Cap: 1.32B

Monthly Green Trade Triangle: 6/3/20 at $7.28

Smart Scan Score: +100

MarketClub members received a new green monthly Trade Triangle early last month on June 3, 2020, at $7.28.

APPS exploded up and moved into the confines of a long-term uptrend. As of August 3, 2020, APPS is up 107% since the monthly trading signal and is still showing major strength.

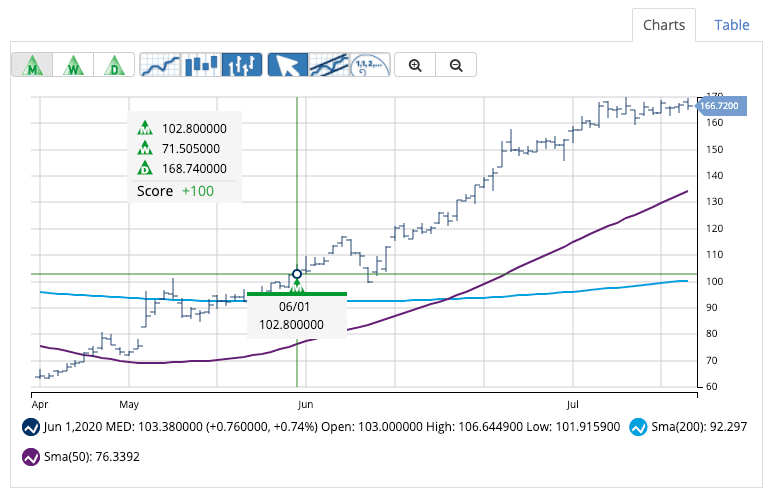

Medifast, Inc. (MED)

Medifast is a leading name in the weight loss and weight management industry. The company manufactures and distributes consumable health and nutritional products in the U.S. and Asia.

Avg. Volume: 286,834

Market Cap: 1.97B

Monthly Green Trade Triangle: 6/1/20 at $102.80

Smart Scan Score: +100

MarketClub members following the long-term strategy have been sitting in MED since receiving a green monthly Trade Triangle on June 1, 2020, at $102.80.

MED has moved up, now touching the $165/share level. As of August 3, 2020, members are hanging tight after a 62% move. The trend continues to hold technical strength and may continue a run higher.

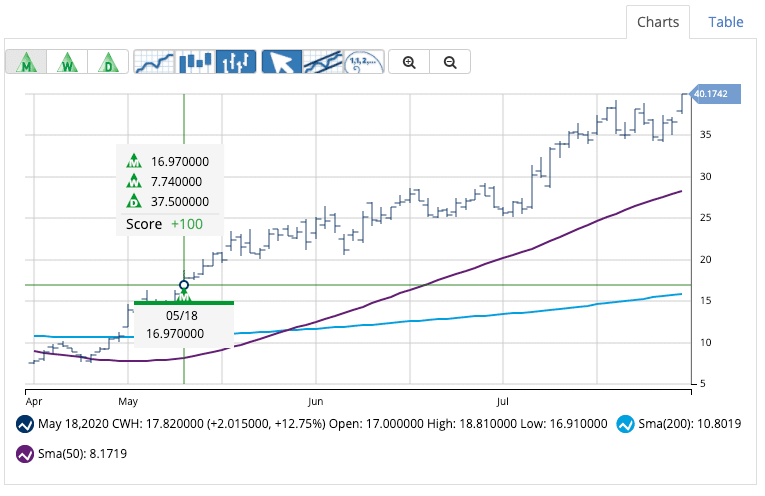

Camping World Holdings, Inc. (CWH)

This company, through its subsidiaries, operates as an outdoor and camping retailer. From recreational vehicle sales to roadside assistance, watercraft products to financing services, Camping World Holdings helps customers at 227 retail locations in the U.S.

Avg. Volume: 2,398,498

Market Cap: 3.52B

Monthly Green Trade Triangle: 5/18/20 at $16.97

Smart Scan Score: +100

While there was a sharp fall in February, 2020 has been good to Camping World Holdings’ stock. The stock has done nothing but rocket to the top since hitting a YTD low on March 18, 2020.

The stock has run more than 136% since the last monthly Trade Triangle issued on May 18, 2020, at $16.97.

With a +100 Chart Analysis Score and solid strength, CWH could continue to push higher. MarketClub members could hold CWH until the trend weakens or until a new trading signal is issued.

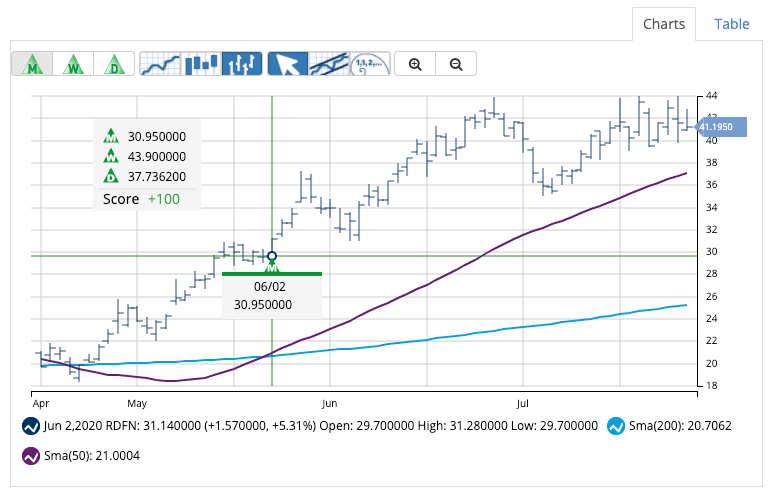

Redfin Corp. (RDFN)

Redfin is taking the real estate market by storm, upending the traditional broker-client model. The company helps customers buy and sell homes with settlement and lending services and an online real estate marketplace.

Avg. Volume: 1,543,634

Market Cap: 4.14B

Monthly Green Trade Triangle: 6/2/20 at $30.95

Smart Scan Score: +100

Redfin traded below the $15/share mark in March of 2020 before a steady move higher, flopping over the $40 level towards the end of June.

A new monthly green Trade Triangle was issued on June 2, 2020, at $30.95. As of August 3, 2020, the stock is up 32.9%. The momentum looks steady for RDFN, and the Smart Scan Score suggests that there is more room to run.

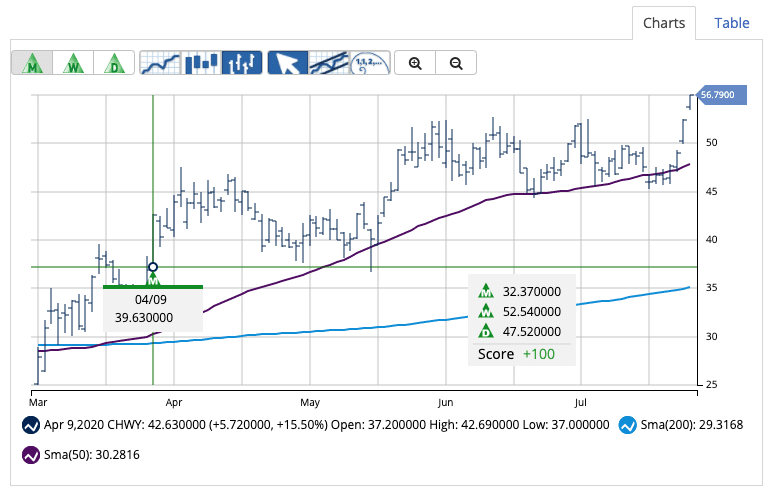

Chewy, Inc. (CHWY)

This e-commerce company provides pet foods, medications, and accessories for U.S. customers. Chewy is a subsidiary of PetSmart and offers more than 60K products from 2K brand partners.

Avg. Volume: 4,485,403

Market Cap: 22.7B

Monthly Green Trade Triangle: 4/9/20 at $39.63

Smart Scan Score: +100

After moving fairly sideways in 2019, the new COVID stay-at-home economy has helped Chewy’s click-to-door model shine.

A new monthly, green Trade Triangle was issued on April 9, 2020, at $39.63. As of August 3, 2020, the stock is up 43%. With a +100 Chart Analysis Score, CHWY has the technical strength to continue its run.

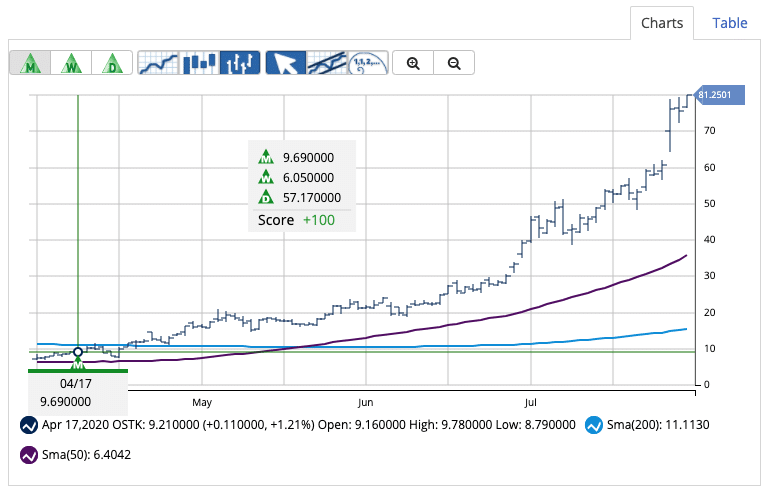

Overstock.com, Inc. (OSTK)

Headquartered in Utah, Overstock is a growing online retailer that brings decor and home furnishing to the doors of customers in the U.S. and internationally.

Avg. Volume: 4,846,057

Market Cap: 3.28B

Monthly Green Trade Triangle: 4/9/20 at $39.63

Smart Scan Score: +100

Overstock’s stock has been like a rocket since members received a green, monthly Trade Triangle on April 17, 2020, at $9.69.

With more than a 700% move to the upside, OSTK is still in a strong bullish trend with technical strength to continue the move.

Changes in price action and momentum may alter the outlook for these 7 hot stocks for August 2020. This does NOT mean you should sit in front of your computer to monitor the action!

Let MarketClub carefully watch these hot stocks for you.

Begin your 30-day MarketClub trial right now to get the signals, alerts, and member-exclusive analysis for the hottest stocks, futures, ETFs, and forex pairs for August 2020 and beyond.