MarketClub’s Trade Triangle technology just issued new buy signals for 3 high volume, well-known stocks.

Our technology has alerted members of these major trend shifts which propel these stocks into levels of great trend strength.

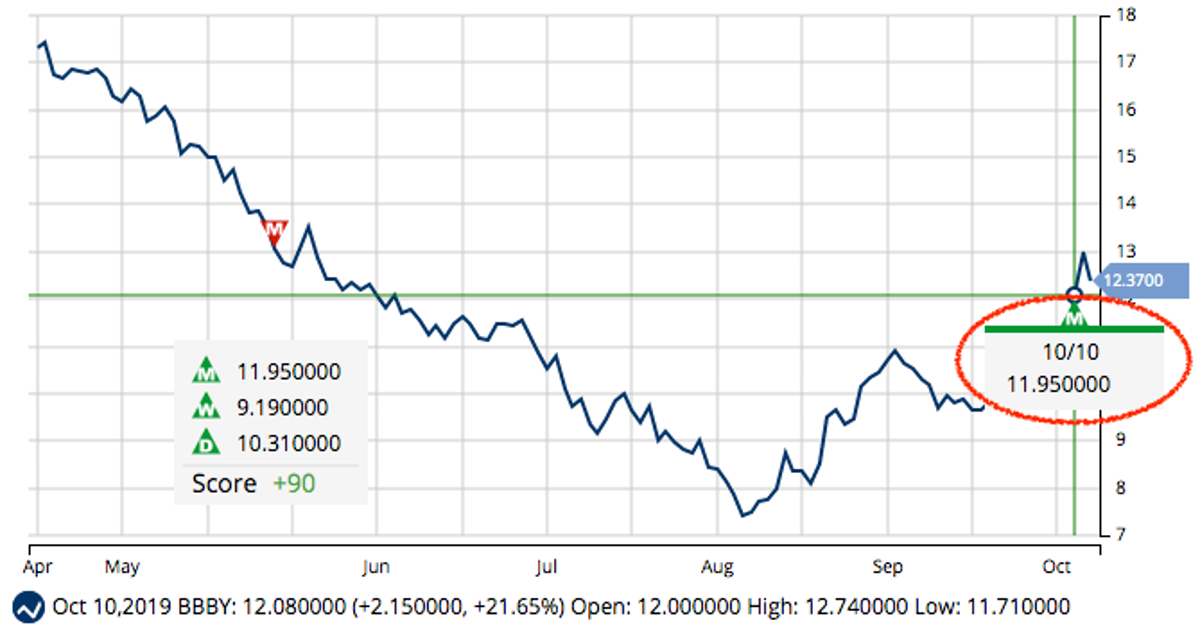

Bed, Bath & Beyond, Inc. (NASDAQ_BBBY)

Bed Bath & Beyond Inc., together with its subsidiaries, operates a chain of retail stores. It sells a range of domestics merchandise, including bed linens and related items, bath items, and kitchen textiles; and home furnishings, such as kitchen and tabletop items, fine tabletop, basic housewares, general home furnishings, consumables, and various juvenile products.

Symbol: BBBY

Avg. Volume: 8,114,164

Market Cap: 1.55B

A new monthly Trade Triangle was issued for BBBY on 10/10/19 at $11.95 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. This Chart Analysis Score of +90 confirms that the uptrend is strong despite a bit of intraday weakness.

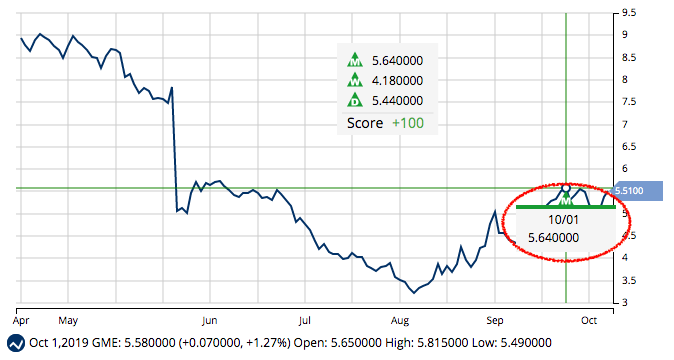

Buy Signal for GameStop Corp. (NYSE_GME)

GameStop Corp. operates as a multichannel video game and consumer electronics retailer in the United States, Canada, Australia, and Europe. The company sells new and pre-owned video game hardware; video game software; pre-owned and value video games; video game accessories, including controllers, and gaming headsets among other items.

Symbol: GME

Avg. Volume: 7,636,978

Market Cap: 498.8M

A new monthly Trade Triangle was issued for GME on 10/01/19 at $5.64 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. A Chart Analysis Score of +100 confirms that GME is in a strong uptrend with the technical backing to continue its move.

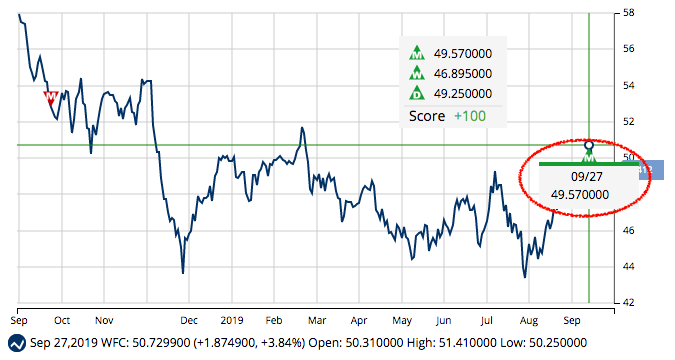

Wells Fargo & Company (NYSE_WFC)

Wells Fargo & Company, a diversified financial services company, provides retail, commercial, and corporate banking services to individuals, businesses, and institutions. It operates through three segments: Community Banking, Wholesale Banking, and Wealth and Investment Management.

Wells Fargo & Company, a diversified financial services company, provides retail, commercial, and corporate banking services to individuals, businesses, and institutions. It operates through three segments: Community Banking, Wholesale Banking, and Wealth and Investment Management.

Symbol: WFC

Avg. Volume: 21,282,682

Market Cap: 217B

A new monthly Trade Triangle was issued for WFC on 9/27/19 at $49.57 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. This stock is rated as a +100 with all trends strongly moving in the same upward direction.

Join MarketClub to get up-to-date lists with new buy signals for stocks, ETFs, futures, forex, and ETFs!