When markets turn volatile and uncertainty reigns supreme, investors look for safety in defensive stocks that generate stable returns through dividends. When it comes to steady dividends, it’s hard to beat a REIT.

A Real Estate Investment Trust (REIT) must distribute at least 90% of its earnings back to investors through dividend payments. With this requirement, REITs are a safe place for investors to look.

One REIT is offering investors safety from the cacophony of Wall Street through its beefy dividend payment and undervalued stock price.

A REIT Topping the Defensive Stocks List

HCP, Inc (HCP) is a $15 billion specialty healthcare REIT based in California. The company primarily manages assisted living facilities. Its real estate portfolio also includes medical offices and other healthcare-related properties.

The company met 1st quarter earnings expectations. HCP reported a gain of $0.13 per share while revenues fell slightly short at $436.1 million. However, the company did add nine new assisted living facilities to its growing portfolio. Moving forward, this should help boost revenues for this defensive stock.

One of the most compelling reasons to pick up HCP right now is the threat of a trade war. The company’s substantial real estate portfolio is limited to the US. Also, the niche healthcare industry is a booming field in high demand.

The stock was upgraded back in January by Robert W. Baird from a “neutral” recommendation to “outperform” as well.

The Fundamental Side

The stock trades cheaply at 14 times earnings compared to the industry average of nearly 60 times earnings. But for a REIT, the impressive ROE (return on equity) of 17%. The ROE is a key performance indicator that is more valuable to investors than earnings alone. Compared to the industry average of 6.6%, HCP’s ROE is telling investors that its investments are outperforming its peers by a wide margin.

As with any REIT, HCP’s most attractive quality is its dividend. Currently yielding 4.80%, HCP is a solid income production play for investors.

Cash holdings increased this quarter as well from $110 million to $120 million. This cash position gives the company even more room to absorb negative economic impacts as well as take advantage of new opportunities as they arise.

The Technical Side

The stock chart shows signs of a reversal pattern. The gap between the shorter-term 20-day SMA is getting close to crossing over the longer 90-day SMA. A longer view of the chart’s yearly performance reveals a higher trending channel as well, indicating solid bullish momentum in the stock. The stock is up over 10% YTD and could continue to rise as positive buying activity heats up.

The Bottom Line

Based on HCP’s full-year EPS estimates, this stock should be fairly valued at around $35 per share. This would be a gain of more than 15% with the dividend yield. Investors that are looking for a stable, high-yield dividend payout shouldn’t think twice about picking up this defensive stock.

The above analysis for HCP was provided by Daniel Cross, professional trader and financial writer.

MarketClub’s Stock Analysis for HCP

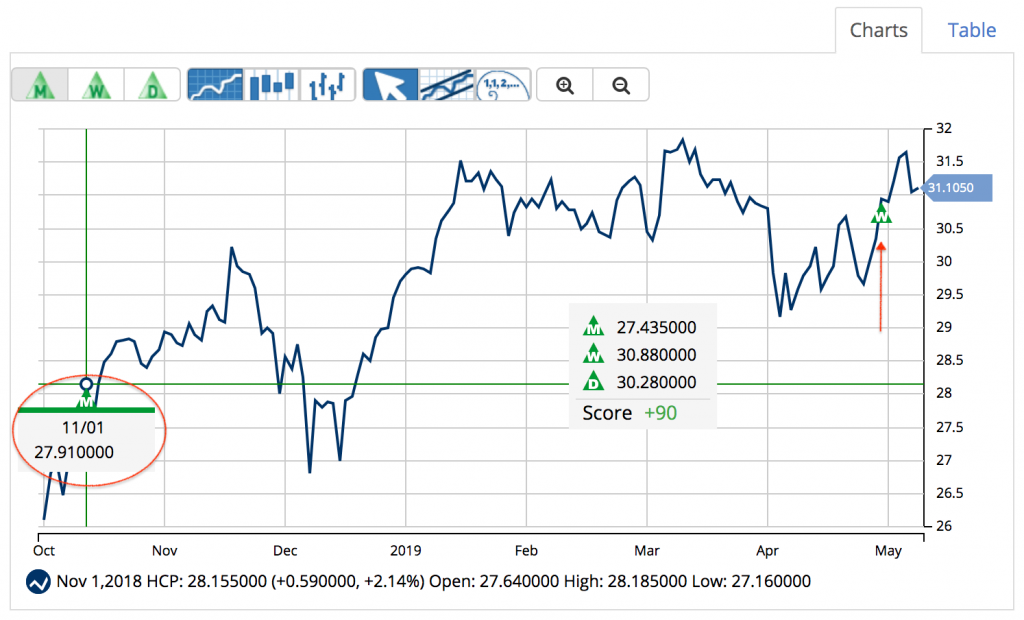

MarketClub’s technology agrees that HCP is in a strong uptrend with a chart analysis score of +90.

MarketClub members were signaled to enter a long position for this defensive stock on 11/1/18 at $27.91.

The stock is currently up $3.19/share (11.4%) since that last long-term signal. Furthermore, a new weekly signal just reconfirmed the stock’s upward trajectory on 5/13/19 at $30.88. This signal could act as a new entry signal for members who missed the signal in November.

Our members got a jump on the move for HCP, but based on Mr. Cross’s analysis, it sounds like there may be more room to the upside for this high-dividend yield defensive stock.

Read More About Our Trade Triangle Signals

When HCP’s trend slows or reverses, MarketClub members will be the first to know. The Chart Analysis Score will drop and a new signal will suggest that the stock may be towards the end of its move.